- Focus on growing our digitally active subscription base and national daily reach

- News & feature was strengthened by the acquisition of Alma Media's regional news media business at the end of April 2020

- Key benefits of the acquisition:

- Growing the digital subscription base and aim to further accelerate digital growth in the acquired business

- Efficiency in shared operation create synergies - full synergies of 13m€ to be achieved by 2022

- Better financial returns on investments in digital capabilities

Independent and trusted media is essential for an open and democratic society

We reach 96% of all Finns every week by providing trusted Finnish journalism and inspiring entertainment. Out of 2.7m households 900k pay for our digital subscriptions.

We have leading positions in our key focus areas

News & feature

#1 in independent domestic journalism, further strengthened by the acquisition of regional news media

Entertainment

#1 in domestic entertainment with most attractive brands and stars

B2B marketing solutions

#1 marketing partner helping companies to grow in Finland

- Leading positions in selected areas:

- #1-2 in TV & video

- #2 in radio & audio

- #1 in live events

- Increasing share of B2C revenue driven by growing demand for subscription-based video-on-demand (SVOD), while the trend for free-to-air (FTA) TV is slightly declining

- Total number of subscriptions for our SVOD service Ruutu+ is above 350k

- YoY growth 10% (October 2023)

- Entertainment has an important role in our total advertising portfolio, and is expected to return to overall growth as corona impact on advertising and events expected to be temporary

- A unique cross-media portfolio offering effective marketing solutions for B2B customers

- Strong growth in digital advertising supported by improved data and targeting capabilities

- High-performing sales teams with superior knowledge of local market and customers

- Tradionally strong position among large customers

- Current market share above 30%

- Increasingly stronger position also among small and mid-sized advertisers through recent acquisitions of regional news media and radio businesses as well as digital offering

- Current market share about 15%

We consider selective opportunities for synergistic bolt-on acquisitions that support growth in our strategic focus areas

Our business is transforming towards digital B2C, supported by digital advertising

- Share of stable B2C income already 52%

- Digital transformation supports margins

Key figures 2024

581m€

Net sales

8.2%

Operational EBIT margin excl. PPA

57%

non-print

2,100

employees

96%

weekly reach

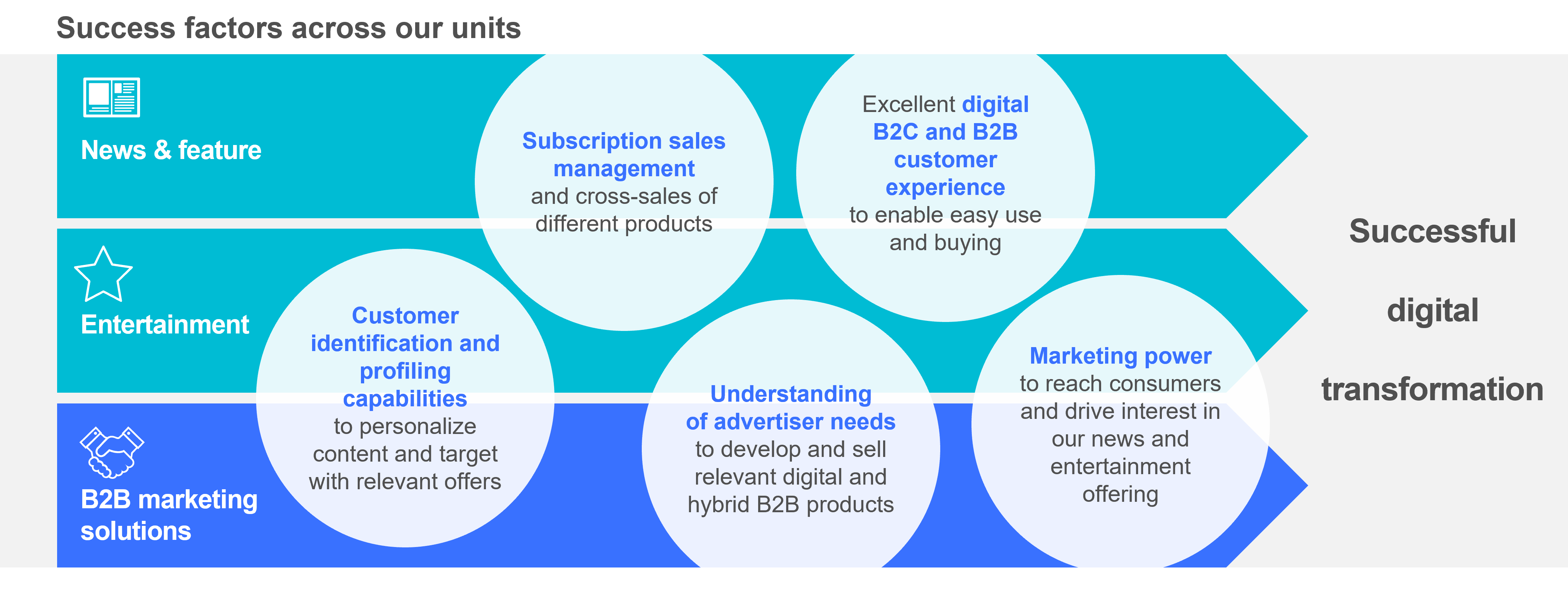

We have a unique set of success factors valuable in the digital transformation